Nvidia, the AI chipmaking titan that was briefly the world’s most valuable company, has suddenly found itself in an unfamiliar position: a major rut.

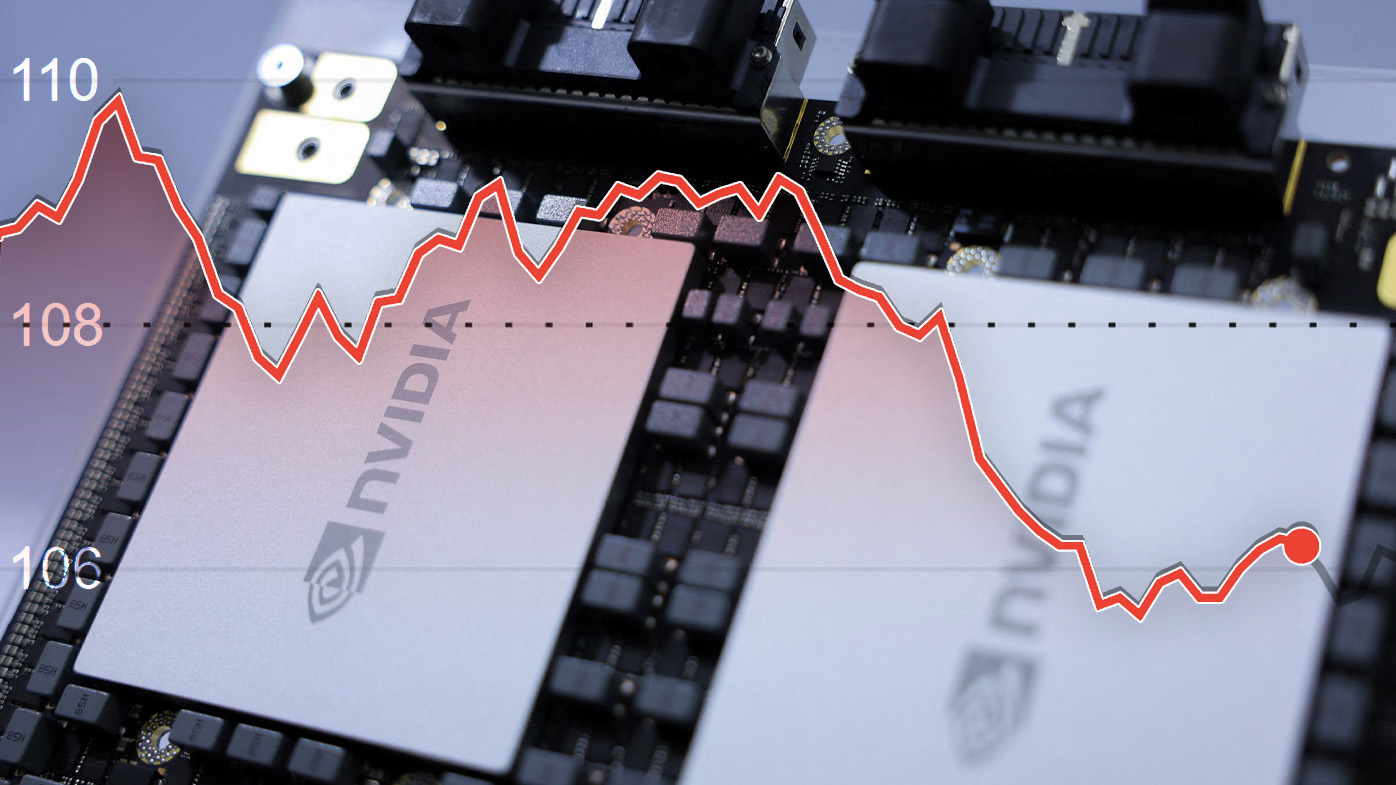

Nvidia (NVDA) had the worst day in the history of the stock market on Tuesday (US Eastern time), as measured by loss in total market value.

Its 9.5 per cent share price decline shaved a stunning $US279 billion ($415 billion) off the company’s value, far outpacing the previous record of $356 billion set by Meta in 2022.

READ MORE: Australian economy records smallest non-pandemic annual growth in decades

To put that shocking decline into context, only 27 companies on the planet are worth as much as Nvidia lost in value on Tuesday. That $415 billion evaporation is worth more than all the shares of some of America’s biggest companies, including McDonald’s, Chevron and Pepsi.

Chief executive Jensen Huang, who is Nvidia’s largest individual shareholder (and fifth-largest overall, counting institutional investors like BlackRock) personally lost $15 billion in wealth on Tuesday from Nvidia’s sharp tumble.

The company has been in decline since June 18, when it topped $US3.3 trillion ($4.9 trillion) in value — the highest for any public company.

As the US economy begins to show some signs of stress, investors have grown skeptical of Nvidia and other AI stocks’ sky-high valuations. Share traders are worried that potential weakness in the economy could make companies think twice before investing in the promising but still risky and unproven technology.

Despite blockbuster earnings last week, Nvidia’s somewhat more tepid outlook disappointed investors who were looking for more upside, and the stock fell.

Nvidia has tumbled more than 20 per cent since its June 18 peak. Microsoft, which has made huge bets on AI technology, has fallen 12 per cent from its most recent peak. And TSMC, Nvidia’s biggest AI chipmaking rival, has plunged 18 per cent since mid-July.

Meanwhile, Intel, once the world biggest chipmaker, has endured a 59 per cent decline in its share price this year. That company faces its own unique challenges in its bid to remake itself and get into the AI game.

Potential legal problems

But Nvidia may face a different set of problems: The government is reportedly investigating it over potential antitrust, or monopoly, violations.

Much of Tuesday’s sharp decline was because the US Justice Department reportedly sent it a subpoena as part of an antitrust probe, according to Bloomberg. CNN could not independently verify the subpoena, and the Department of Justice declined to comment directly on a potential antitrust investigation.

Nvidia on Wednesday afternoon said it has not received a subpoena from the Justice Department.

“We have inquired with the US Department of Justice and have not been subpoenaed,” an Nvidia spokesperson said in a statement. “Nonetheless, we are happy to answer any questions regulators may have about our business.”

The Biden administration has been going hard after tech titans, launching probes and lobbing charges against Apple, Google and Amazon, among others. It’s unclear whether a Kamala Harris or Donald Trump administration would continue those cases, but both have criticised tech companies for various reasons during their campaigns.

links to content on ABC

9News